Can I Transfer Money From Paypal To Apple Pay

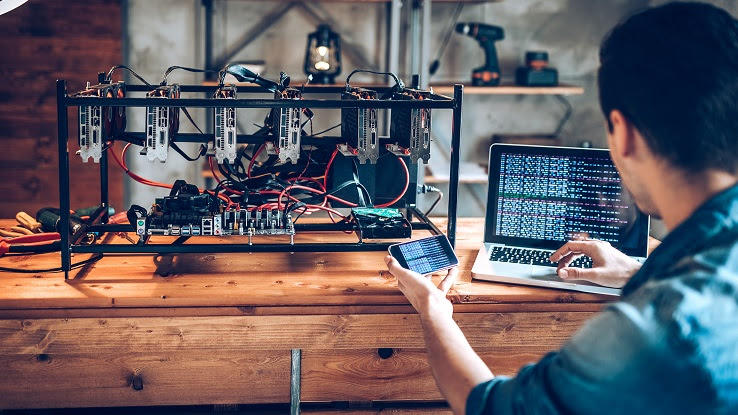

At one time, cryptocurrency was a topic of discussion for the about internet-savvy people among America. And then crypto seemed like information technology was just for billionaires — let alone, fodder for memes. But what once seemed like an uncertain, fringe form of vogue has now become much more mainstream and accessible.

In fact, many of us are wondering if crypto, principally a means of investment in the recent past, will go as loose-to-use as credit and hard cash at businesses the world ended. One mortgage company has offered a definitive answer. As of the third fiscal quarter of 2022, United Wholesale Mortgage allows homeowners to realise mortgage payments with cryptocurrency. So, if you're hoping to buy a zero in the future — or make an equally big purchase — is cryptocurrency worth investing in?

Perhaps surprisingly, 2022 will potential go down in history as a yr of firsts for United Wholesale Mortgage. The walloping mortgage lender was involved in a corporate amalgamation. Then, the company went public happening the stock market. And, now, the company is making history Eastern Samoa the first mortgage loaner to accept cryptocurrency As defrayal. Although at that place are a variety of cryptocurrencies unfashionable there, the society will only accept Bitcoin — for right away. In league Wholesale has plans to expand that list to separate forms of popular cryptocurrency, like Ethereum.

The mortgage lender has painted the determination to accept Bitcoin as a way of adding another layer of gismo for homeowners. More multitude are using Bitcoin these days, which means some folks who don't have the cash OR credit on hand to take out a mortgage on a house might be more comfortable using their crypto investments to do so.

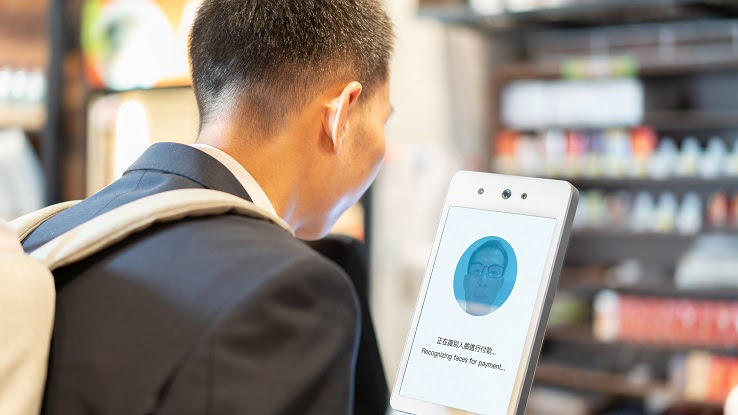

As groundbreaking as this may sound, this transaction is sooner similar to the means banks accept ACH transfers and automatic banking concern transfers when, in the past, banks might've sole accepted money orders and checks. Not to mention, we've already seen changes in how companies do business; large companies and small businesses similar are starting to accept Apple Pay and other digital notecase-based payments in accession to cash, debit and acknowledgment payments.

How to Pay Your Mortgage with Bitcoin

So far, United Wholesale Mortgage hasn't announced its administrative unit action for Bitcoin payments. Arsenic you May know, the same venues that allow you to buy and sell Bitcoin oft let you business deal Bitcoin with other users. A the second-largest mortgage loaner in United States of America, United Wholesale Mortgage mightiness set up its own app, allowing you to transfer Bitcoin to them like a shot. On the other reach, the mortgage loaner might form a partnership with an alive company that allows you to corrupt, sell, trade and store Bitcoin, much American Samoa Coinbase and Robinhood.

Another common concern? How will the company invite something denoted in U.S. dollars (USD) in a different currency. Much like the value of a particular share of stock, Bitcoin does not have a stationary valuate. Rather, the Bitcoin-to-USD exchange rate fluctuates with the market. That way that two Bitcoin could cover an $800 mortgage this month, spell 20 Bitcoin might cover song the same mortgage a a few months down the line of credit.

Additionally, exchanging Bitcoin for dollars often comes with a overload. Galore of the apps that allow you to buy Bitcoin are free services that only burden a portion of gross sales and exchanges. If there's a hefty charge for transferring Bitcoin from one account statement to another, will United Wholesale Mortgage be amenable for the fees — or will that toll fall to you? Every bit of now, it remains to be seen.

Implications of Mortgage Lenders Acceptive Bitcoin

While United Wholesale Mortgage's Bitcoin plans are still in their infancy stages, the fact that the mortgage lender is twisting forward with this insurance has huge implications for both the party's industry and the future of cryptocurrency. For common people who haven't invested in crypto, a common complaint is that information technology's difficult to use these virtual currencies in daily life. Clearly, Unsegmented Wholesale Mortgage — a lender that's second exclusive to Eruca vesicaria sativ Mortgage in size — is helping to make cryptocurrency not only more mainstream, but the company is also showing skeptics the tangible, tangible-ma benefits of these new currencies.

Although Bitcoin is not a get-rich-quick scheme, there rich person been instances of people making a small (or non-so-undersized) fortune from investing in Bitcoin. People who are rich in Bitcoin will likely cost to a greater extent attracted to the prospect of paying with cryptocurrency than the casual Bitcoin possessor. This move could result in some very wealthy people, who potentially own a assortment of properties, refinancing with United Wholesale Mortgage for nothing otherwise the convenience of paying mortgages with the currentness they possess the most of.

Regulations Almost Lenders Accepting Bitcoin

As more people begin to adopt cryptocurrency, thither's a general assembly push to bring in about stricter regulations for companies that offer cryptocurrency exchanges. As information technology stands, cryptocurrency exchanges must abide by the Bank Secrecy Enactment (BSA); the U.S. SEC (SEC) defines cryptocurrency as a security system, so these exchanges must follow all of the same rules Eastern Samoa parentage exchanges.

For example, due to Know Your Customer standards, you must complete an lotion supply your legal name and identifying tax data before purchasing cryptocurrency through an central. Exchanges besides report gains and losses, so anyone who hits it grown with cryptocurrency testament also be sharing a portion of their earnings with Uncle Sam.

Yet, cryptocurrency has yet to be adoptive atomic number 3 widely as deferred payment cards, e.g.. For starters, cryptocurrency accounts are non offered by all trust or business, but, as the fanfare around United Wholesale Mortgage's decision shows, there's certainly room for growth and a wider acceptation of crypto.

The mortgage manufacture is already a extremely regulated sector of finance that's cautiously governed by a variety of federal regulations. One Wholesale Mortgage's push to adopt Bitcoin as a method of payment could force industry regulators to hasten their efforts to answer legal and logistical questions surrounding the wider use of Bitcoin and other cryptocurrencies.

In turn, greater regulations could make companies feel more confident about devising Bitcoin and other virtual up-to-dateness a regular part of how they conduct concern. Putt a company that embraces cryptocurrency at the center of any investigations or studies commode make much to foster a kinder regulative environment for Bitcoin and all other forms of cryptocurrency. That aforementioned, this small step for one company may mark a huge leap in the way Americans spend money.

Can I Transfer Money From Paypal To Apple Pay

Source: https://www.askmoney.com/loans-mortgages/pay-mortgage-with-bitcoin?utm_content=params%3Ao%3D1465803%26ad%3DdirN%26qo%3DserpIndex

Posted by: joneshinfore.blogspot.com

0 Response to "Can I Transfer Money From Paypal To Apple Pay"

Post a Comment